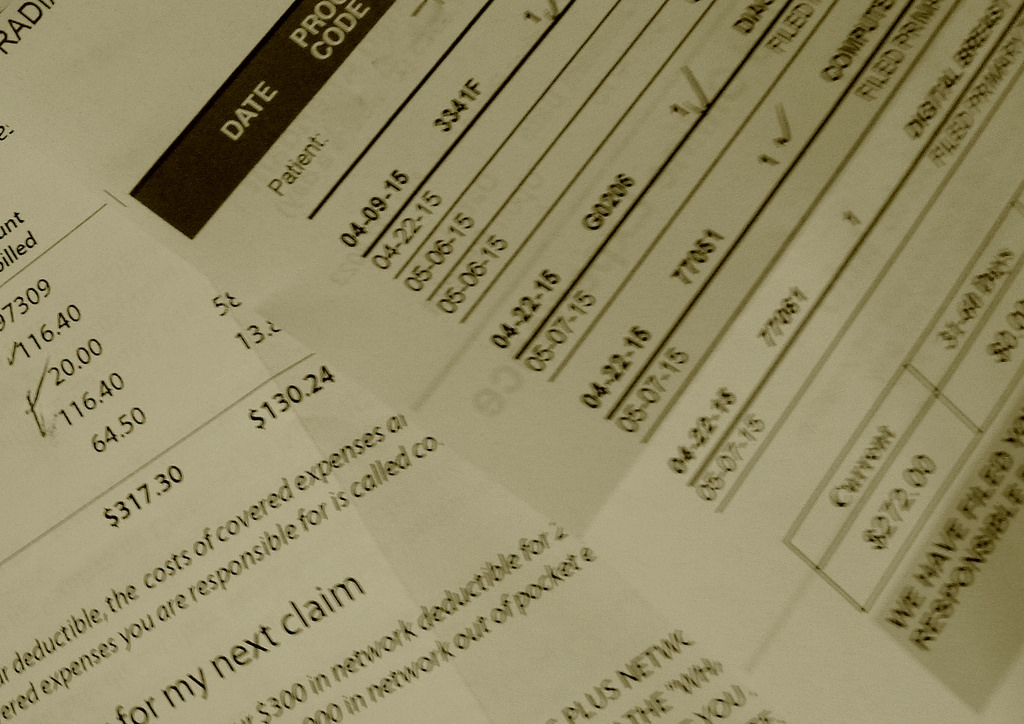

While medical air transport is, no doubt, a life-saving necessity, the bills that the service generates can be quite shocking in most instances. The one belief that lands people in a financial mess is that having a medical insurance is enough to cover the medical air transport bill. Nothing could be far from reality. Insurance companies usually have a tie-up with only a few air ambulance companies. The rest of the companies are considered “out of network” by these insurance providers. What makes it worse is that medical emergencies do not always allow people to choose the in-network companies. When it’s a question of life and death, the quickest service is always the first priority.

Medical Air Transport Requirements are Real – Plan Them

“Prevention is better than cure” and this saying holds true for medical air transport planning. People need to get out of denial thinking, “Oh, that’s a farfetched requirement for me.” Memberships are offered by most air ambulance companies at a very reasonable price. Availing these is the wisest thing you can do.

What if You Do Not Have Air Ambulance Coverage or Membership?

Let’s consider a scenario where you end up with a huge medical air transport bill and you’re absolutely unable to pay it; plus your health insurance refuses to cover it. Get in touch with the air ambulance company, tell them your financial status and make it clear to them what you can pay. Most companies will agree to what you can pay (or at least a figure close to it). The reason is simple – a smaller payment is better than no payment at all.

You can request them for a payment plan, if you think you can pay it over a period of time. Also, negotiate with your health insurance company and try to get them to pay more. Do not shy away from taking legal opinion if it comes to that.